GT Accountant

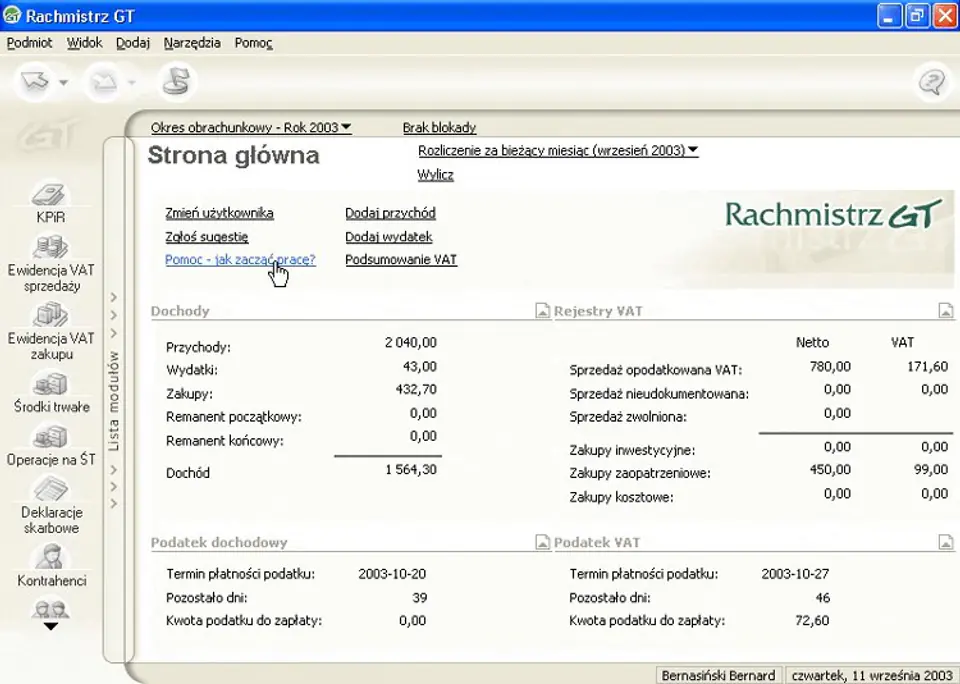

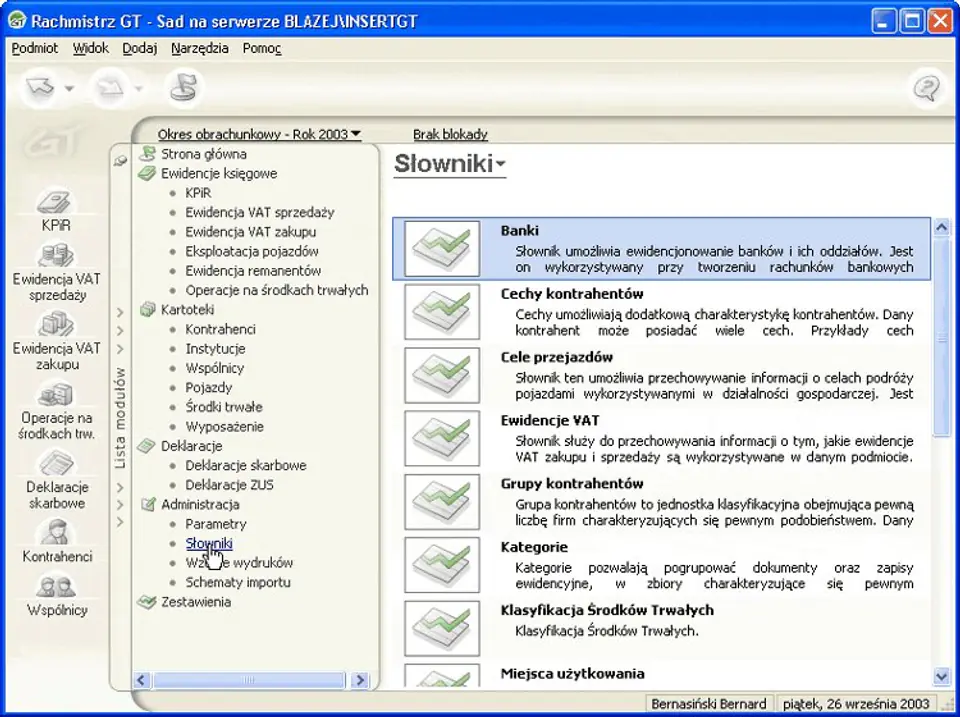

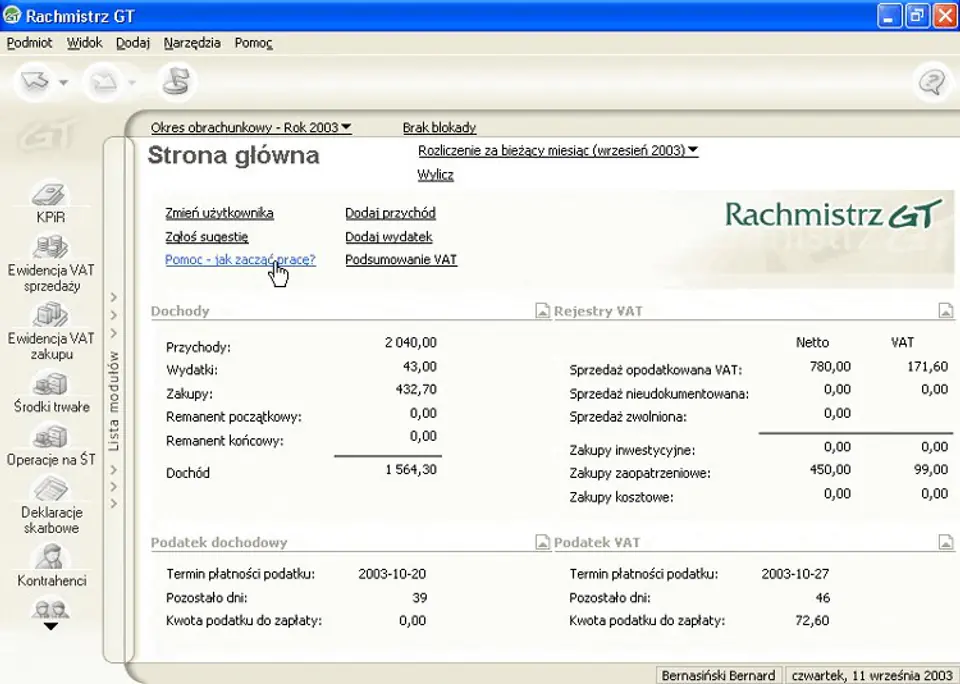

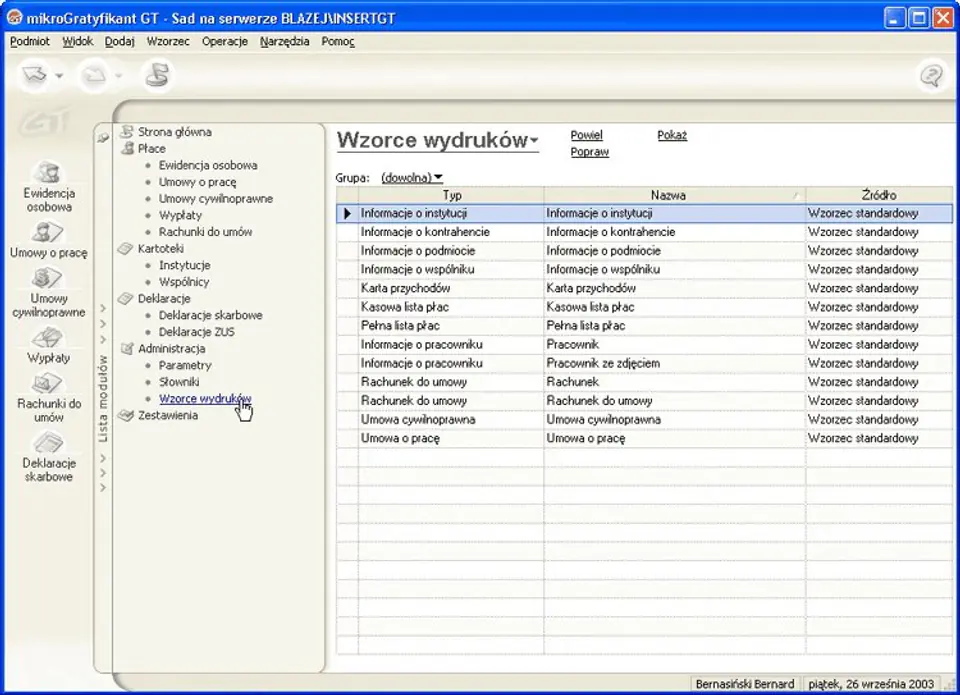

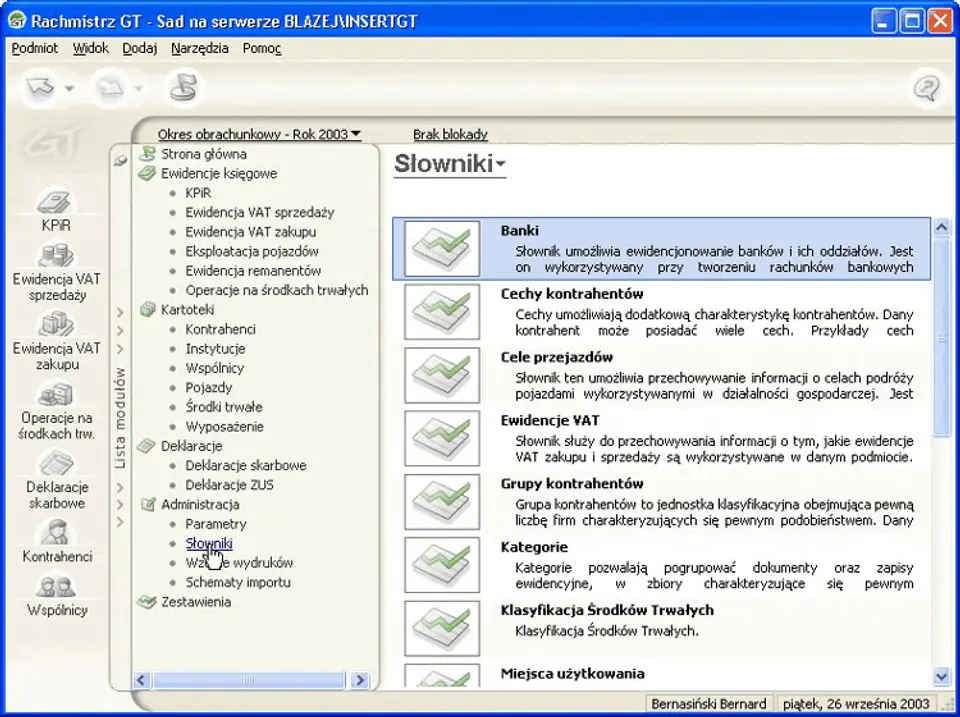

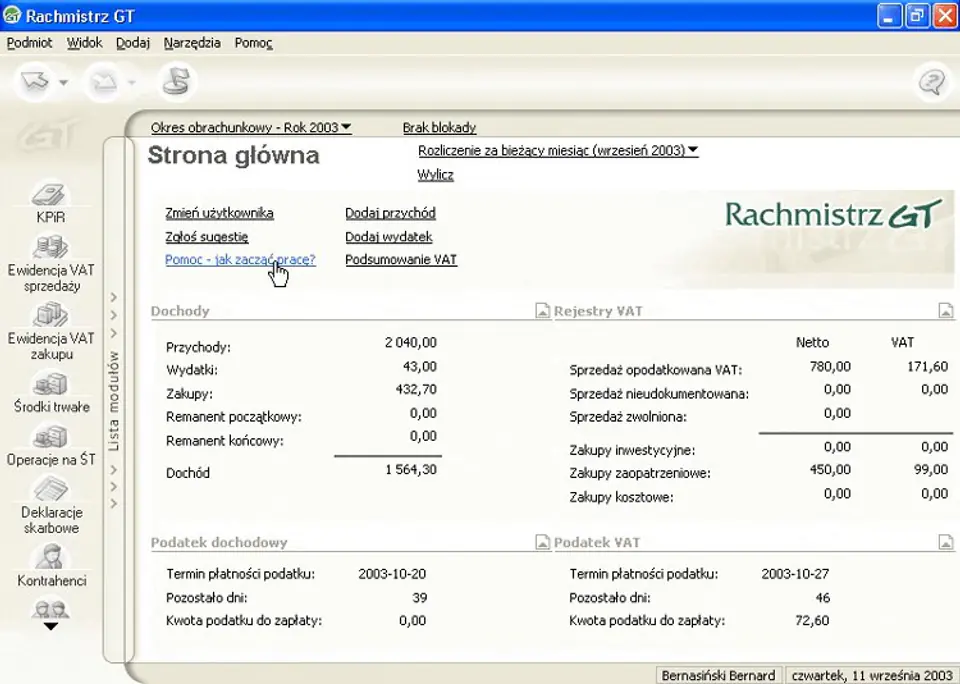

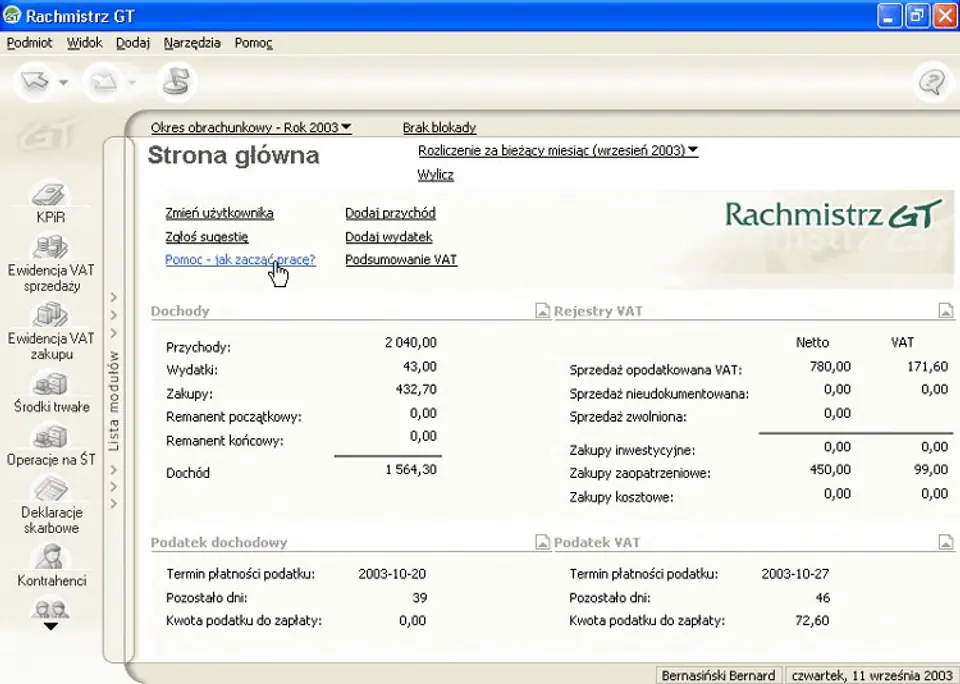

Rachmistrz GT is a modern system for simplified accounting. We recommend this program to companies keeping a book of revenues and expenses and flat-rate tax payers who settle in the form of a lump sum on recorded revenues. Rachmistrz GT is an excellent tool for both companies that independently document business activity and accounting offices. Thanks to the gt microGratyfikant program included free of charge, basic payroll service is also possible.

Rachmistrz GT is another version of InsERT programs known in Poland: Countmaster 4 and Countmaster for Windows. It is an efficient system equipped with the latest interface solutions that make it a very ergonomic and user-friendly program.

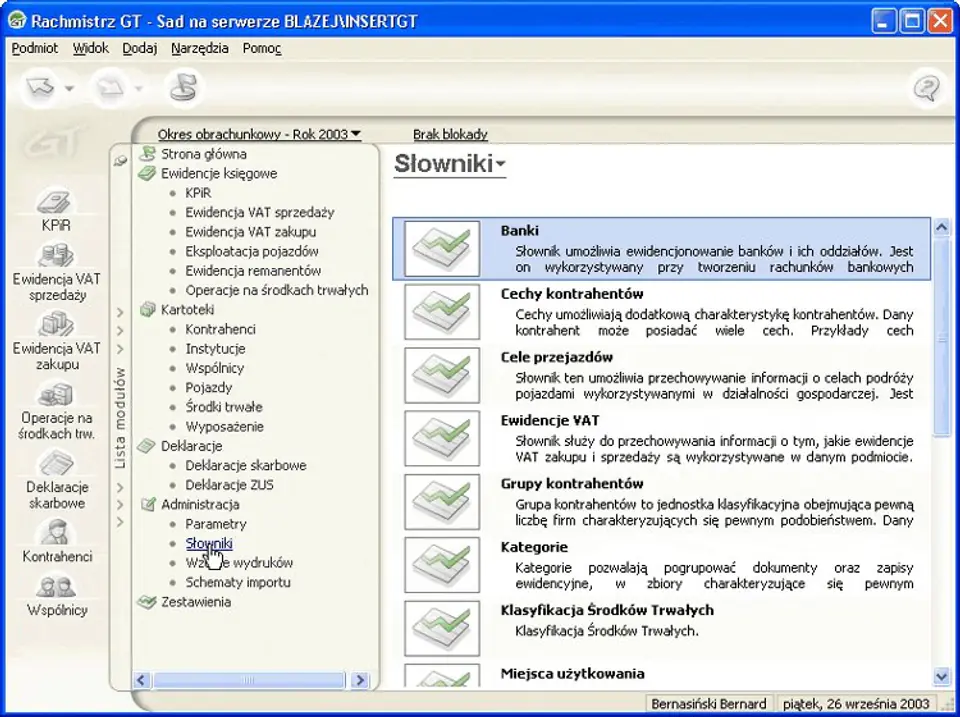

The GT Accountant is part of the InsERT GT line, which also includes Subiekta GT - a sales service system for small and medium-sized companies, GT Revisor - a program for keeping a commercial book, Gratyfikanta GT HR and payroll system and Gestora GT customer relationship management system. The database engine used in the InsERT GT line programs is Microsoft SQL Server 2008 R2, which in the free Express Edition comes with the system.

The most important features of the GT Enumerator:

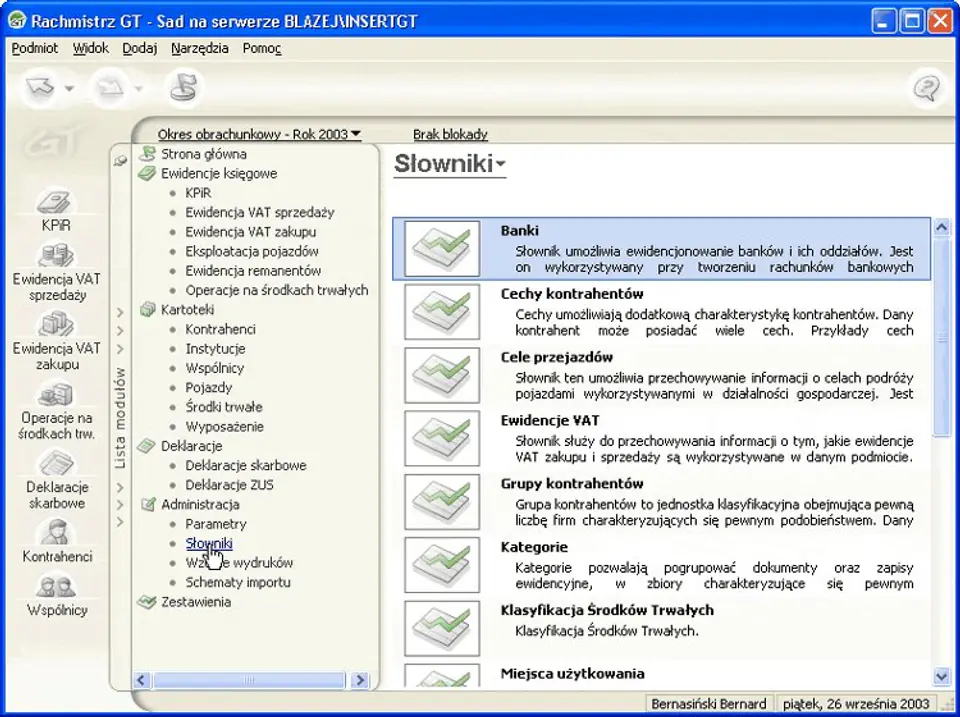

- keeping a book of revenues and expenditures or records of flat-rate tax (depending on the chosen form of accounting);

- keeping VAT records: purchases, sales, including recording EU transactions; the possibility of introducing undocumented sales settled by the purchasing structure;

- keeping records of vehicle data used for business purposes, accounts related to the operation of vehicles and records of vehicle mileage;

- keeping records of fixed assets and intangible assets (calculation and accounting of depreciation, printing of the depreciation plan), as well as keeping records of equipment and inventories;

- keeping a file of contractors and partners (individual parameters regarding settlements with ZUS, automatic posting in costs or deduction of ZUS contributions and other funds from income, calculating and documenting the advance payment for income tax with an appropriate report);

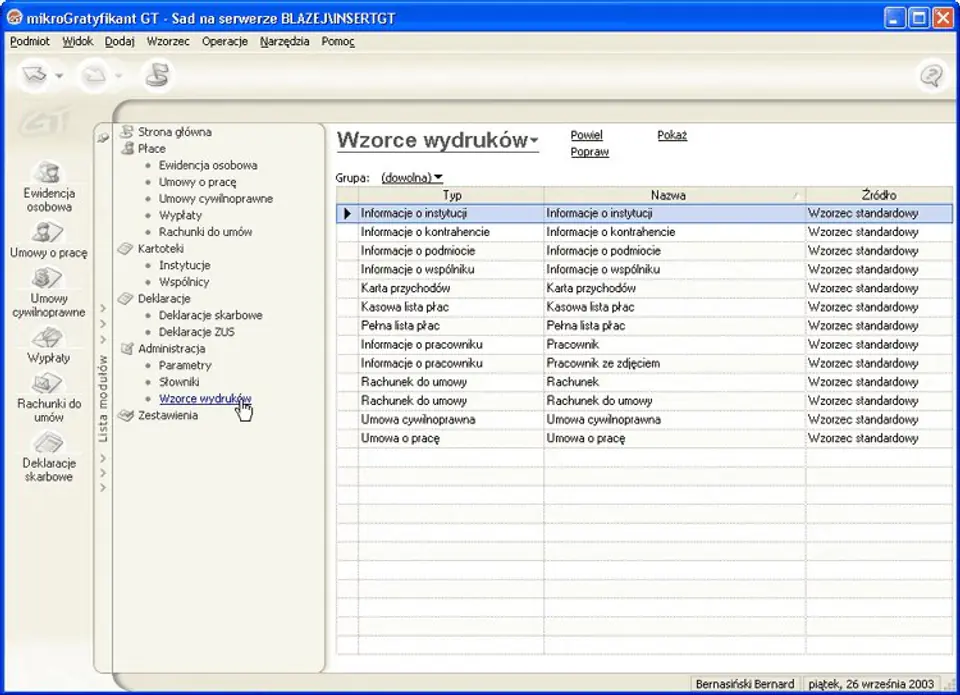

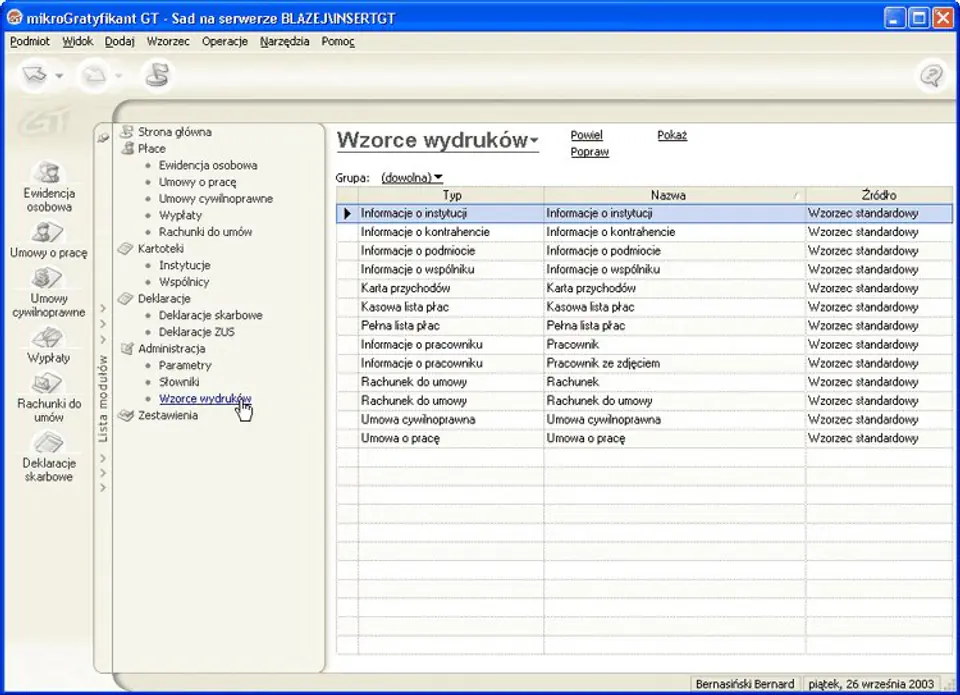

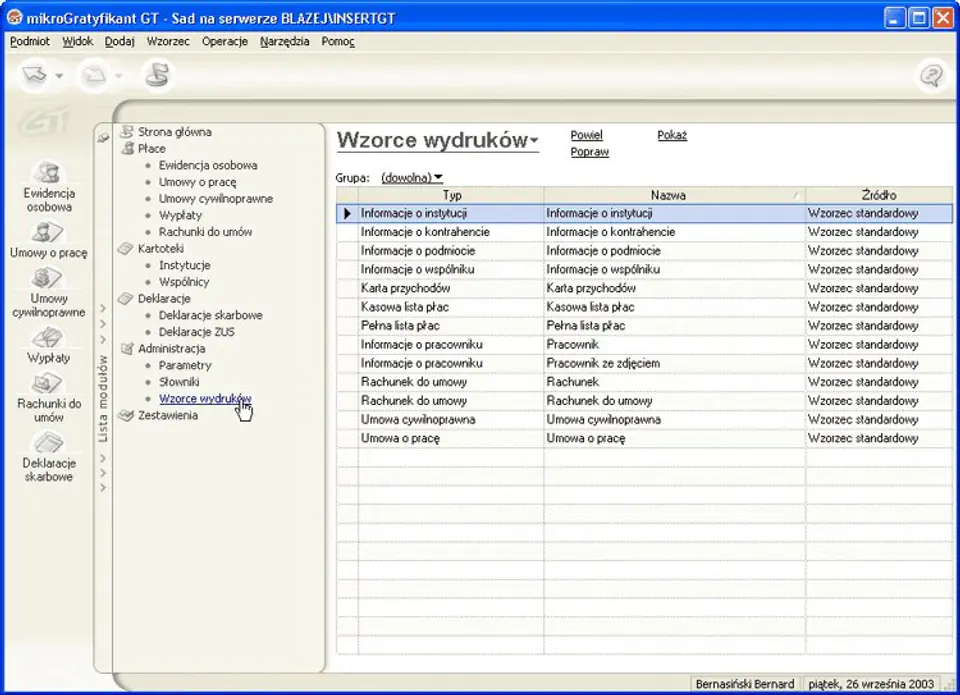

- extensive remuneration services: personal records, civil law contracts and employment contracts; issuing bills for civil law contracts and payments (including the possibility of automatic calculation based on defined remuneration schemes);

- calculation, printing and full service of electronic shipment of tax returns (together with the necessary attachments): VAT-7, VAT-7K, VAT-7D, VAT-EU, PIT-11, PIT-36, PIT-36L, PIT-37, PIT-40, PIT-4R, PIT-28, PIT-8AR;

- handling corrections of tax declarations with electronic mailing;

- issuing ZUS declarations (DRA, RCA, RZA) and the possibility of exporting to the ZUS Payer program;

- integration with the Subiekt GT sales support system and the possibility of cooperation (via the Communication option) with other systems (e.g. Subiekt for Windows, Subiekt 5 EURO, mikroSubiekt for Windows).

The GT accountant is also available in a special offer prepared for accounting offices and tax advisors, which allows you to purchase the program in a promotional set.